Money Savvy

Are your staff equipped with the right financial skills and confidence to succeed at work and beyond?

Give your team the financial skills and confidence to thrive – at work and beyond. Our Money Savvy programme equips staff to set goals, manage budgets, understand debt and saving, and make smarter money choices every day

Best for

Operational workforce

Duration

Weekly/Fortnightly group sessions x 2-hrs (flexible day and time)

$4900 + GST per group

$7500 + GST per group

NZQA qualification

No

Location

On-site

Format

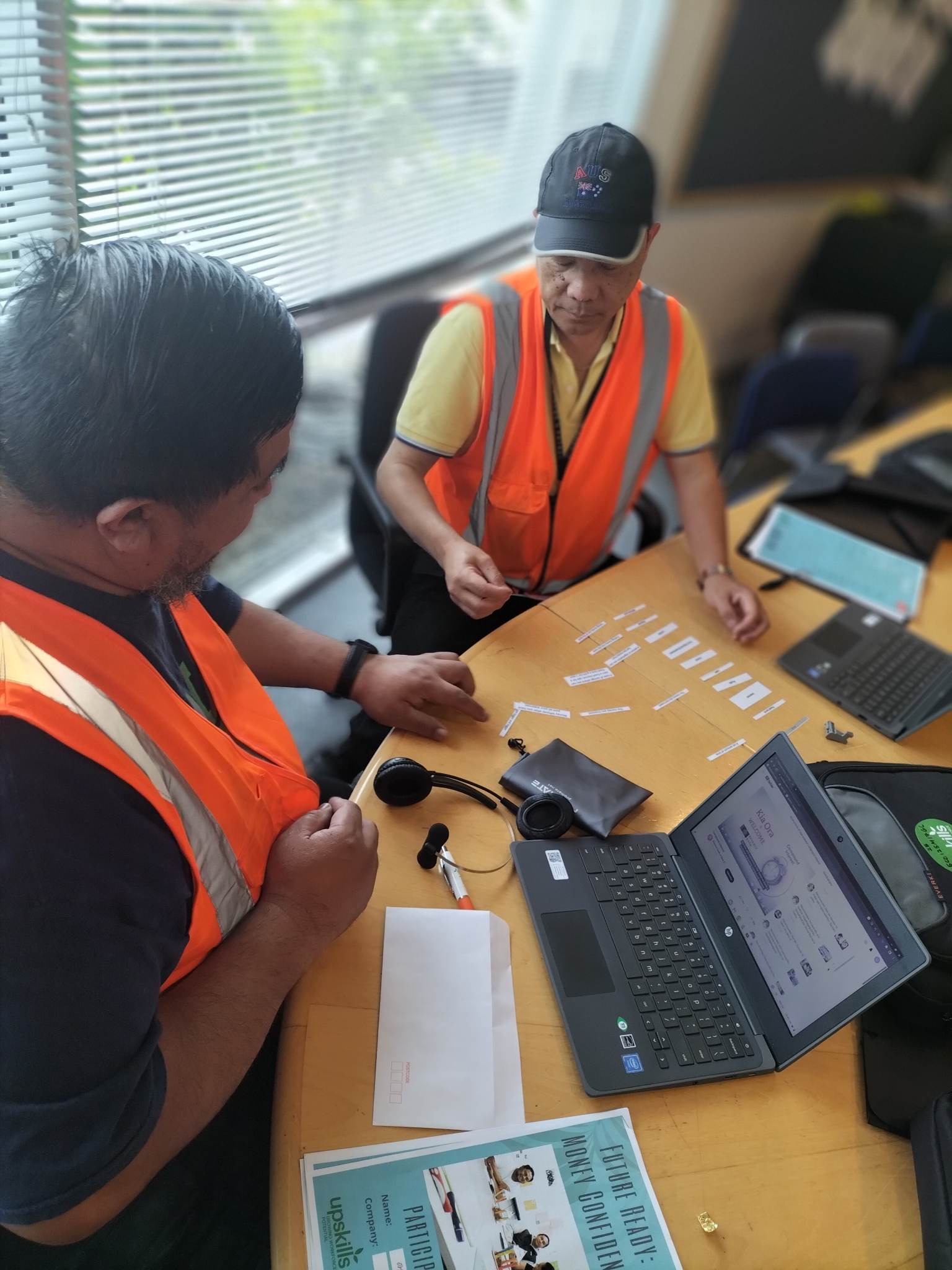

Client cohort

Participants in this programme will grow their get confidence with the financial basics:

Choose from a range of outcomes to build the learning experience

Money Savvy Intro

- Get sorted: Set personal financial goals, track expenses via a spending diary, identify personal needs and wants

- Know the true cost of debt – financial and legal obligations

- Understand the power of compound interest when saving

- Kiwisaver -know the numbers – employee and employer contributions, fees, government top ups, read a Kiwisaver statement with confidence

Optional add on modules

Money Savvy Home Ownership

- Evaluate strategies for home ownership

- Saving strategies for a deposit

- Using Kiwisaver for Home Ownership

- Getting a mortgage

Money Savvy Plan for Retirement

- Set a retirement vision

- Know Kiwisaver and what’s right for you

- Explore investment options

- Explore ideas for generating more income in retirement

Format

Format of deliver is flexible depending on your organisation’s needs. Training delivery is on site at your workplace and we can deliver this programme nationwide.

Talk to us for more details

Contact Holly Patterson at Upskills on 021 156 3242 to find out more about how this course can help your people become money-savvy.